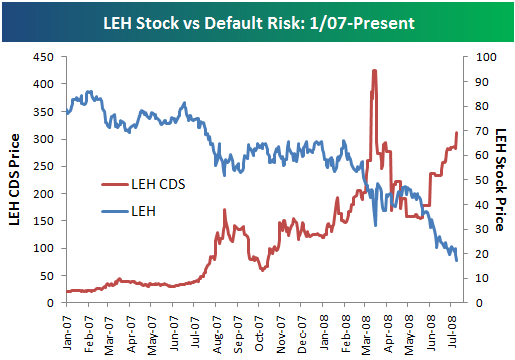

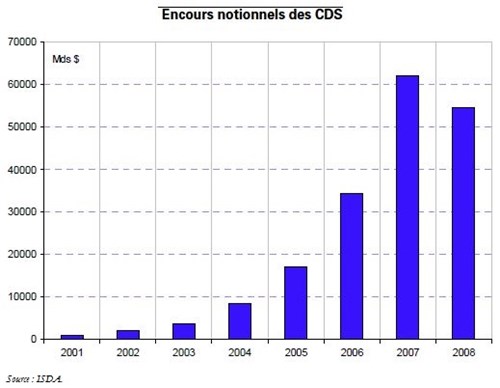

CDS market believed Lehman Brothers was solvent until shortly before... | Download Scientific Diagram

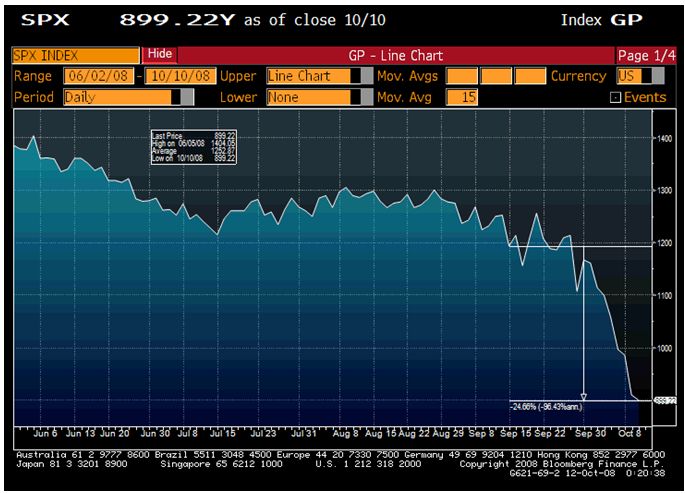

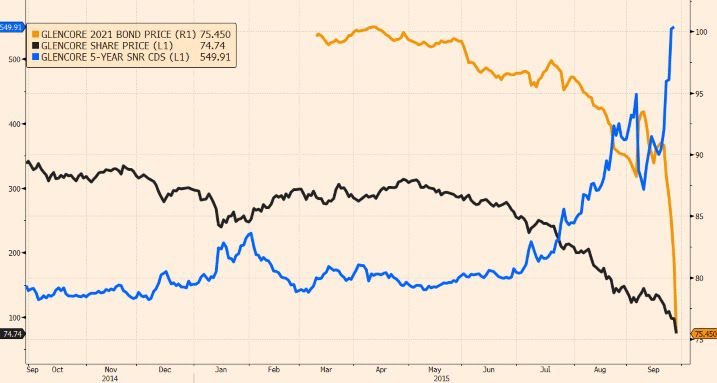

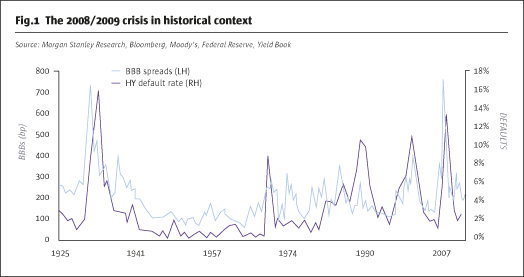

Witnessing a Lehman Brothers moment in front of our very eyes. Here in 2 Pictures: 2008 and Today in 2022. The vultures are buying Credit-Default Swap (CDS) bets on a dying bank

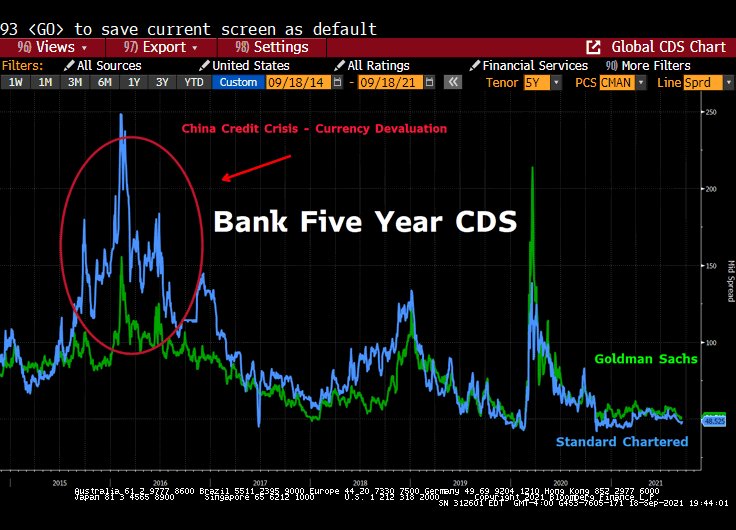

Lawrence McDonald on X: "'China's Lehman Brothers moment' - What are our 21 Systemic Risk indicators saying about the Evergrande credit crisis? Important Take here: https://t.co/yMqlsylk8W https://t.co/KxrAyMx8k7" / X

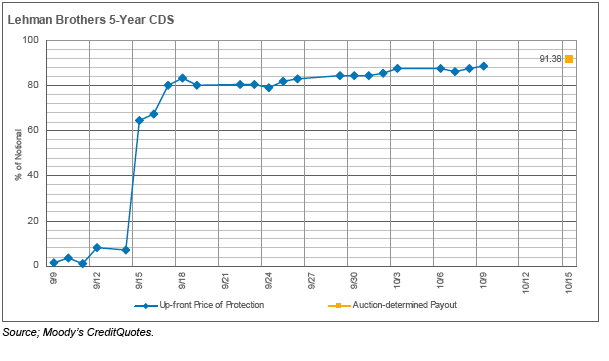

Six-weeks of Lehman Brothers CDS quotes. This figure depicts the time... | Download Scientific Diagram